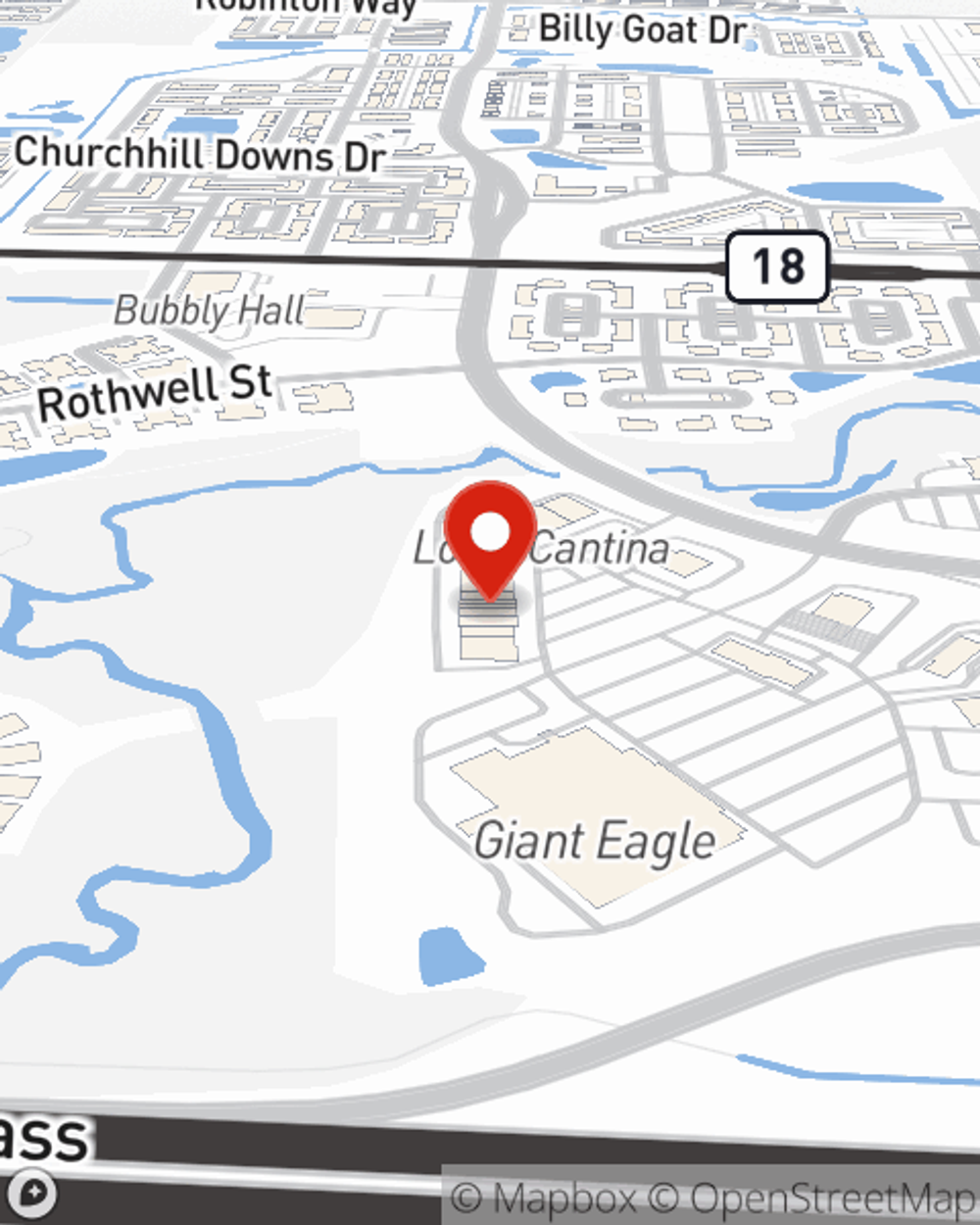

Insurance in and around New Albany

Protect the life you've built

Customizable coverage based on your needs

Would you like to create a personalized quote?

Celebrating 100 Years Of Good Neighboring

Wondering how you can help protect yourself, your loved ones, and the life you've built in a world that often throws the unpredictable at you? Ask agent Jonathan Yu how you can construct a Personalized Price Plan® that's right for you. And while you're at it, check out State Farm's safe driving rewards, bundling options and discounts!

Protect the life you've built

Customizable coverage based on your needs

Our Broad Range Of Insurance Options Are Outstanding

Want to know why State Farm is the largest insurer of automobiles and homes in the U.S.? Great insurance coverage options, competitive prices, easy claims and excellent service might have a lot to do with it. Or maybe you're looking to help secure your family's financial future. Let us help you ease that burden. The unmatched strength of State Farm Life Insurance, a wide range of products and Personalized Price Plans; it's a great value and smart choice.

Simple Insights®

What are bond funds?

What are bond funds?

Investing in bond funds may offer regular fixed income and tend to have less risk than most stock funds. Read more.

Personal net worth

Personal net worth

A personal net worth statement is a snapshot of your financial health. This article provides a worksheet and explains what should be included.

Jonathan Yu

State Farm® Insurance AgentSimple Insights®

What are bond funds?

What are bond funds?

Investing in bond funds may offer regular fixed income and tend to have less risk than most stock funds. Read more.

Personal net worth

Personal net worth

A personal net worth statement is a snapshot of your financial health. This article provides a worksheet and explains what should be included.